Brazil Shipments Require CPF Tax ID as of January 1, 2020

Tax ID Requirements for Shipments to Brazil

Effective January 1, 2020, all shipments to Brazil must include the recipient's Tax ID number on customs declarations and shipping labels.

Any shipments missing the recipient's Tax ID will be subject to return, or even disposal, by Brazilian Customs.

Receiving Orders from Brazilian Customers

When Brazilian customers place an order at your store, make sure to collect their CPF (Individual Tax ID) or CNPJ (Business Tax ID) number.

This Tax ID information must be included on the Customs Form.

Preparing Shipments to Brazilian Customers

When preparing shipments to Brazil, make sure to include the recipient's Tax ID number in the recipient Company Name field.

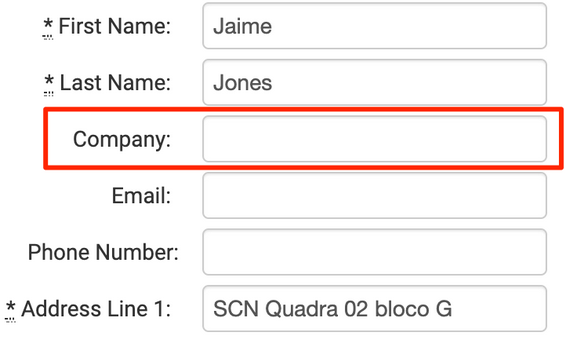

When preparing a shipment to Brazil to an individual, the Company field is will initially be left blank.

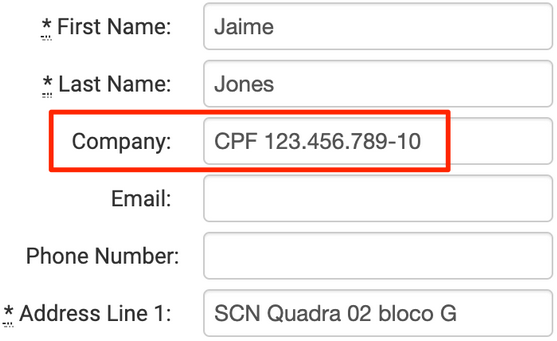

If the Recipient is an Individual

In the Company field, enter the recipient's tax ID information.

Formatting an Individual's Tax ID

The format of an individual's tax ID should be 3 groups of 3 numbers separated by a period (.) and then a dash (-) followed by the final 2 numbers.

Ex: 123.456.789-10

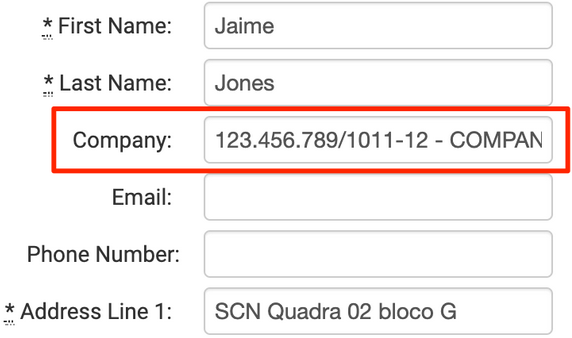

If the Recipient is a Business or the Customer Included a Business Name

In the Company field, enter their Business Tax ID, followed by a dash (-), followed by their business name.

Formatting a Business Tax ID

The format of a business tax ID should be 3 groups of 3 numbers separated by a period (.) followed by a forward slash (/) followed by 4 numbers, then a dash (-) and 2 final numbers.

Ex: 123.456.789/1011-12